Norway

Synthesis

major macro economic indicators

| 2020 | 2021 | 2022 (e) | 2023 (f) | |

|---|---|---|---|---|

| GDP growth (%) | -1.9 | 4.0 | 3.3 | 1.3 |

| Inflation (yearly average, %) | 1.3 | 3.5 | 5.8 | 5.3 |

| Budget balance (% GDP) | -2.6 | 9.7 | 16.0 | 16.0 |

| Current account balance (% GDP) | 1.1 | 15.0 | 30.0 | 31.0 |

| Public debt (% GDP) | 45.9 | 43.2 | 36.0 | 32.0 |

(e): Estimate (f): Forecast *The public budget includes withdrawals from the Sovereign Wealth Fund

STRENGTHS

- Huge oil and natural gas deposits; the energy sector accounts for 36% of GDP, 16% of investments and 64% of exports

- High standard of living

- Largest sovereign wealth fund in the world (around 341% of mainland GDP in 2022; the fund owns almost 1.5% of all shares in the world)

- Norway has a preferential access to the EU market and is a NATO-member state

WEAKNESSES

- Structural budget deficit when excluding oil and gas revenues

- High private household debt (81% of nominal GDP in Q3 2023)

- Significant labour costs and shortage of skilled workers

- Exposure to climate risk (such as significant drought in 2022, which jeopardises the hydroelectric power stations’ operations, particularly in the south)

RISK ASSESSMENT

Slower but still growing economy in 2024, helped by hydrocarbon production

In 2024, Norway's domestic economy faces challenges as high interest rates exert downward pressure on household consumption and housing investments. Despite a robust labour market, marked by growing employment, the housing sector is experiencing the backlash of elevated interest rates. The increased supply of houses on the market suggests a potential downturn, with expectations of lower prices in the coming year. This shift in the housing market dynamics may influence consumer sentiment and overall economic activity. Easing interest rates during 2024 coupled with positive wage growth are likely to provide a much-needed boost to household consumption in the latter half of 2024. This cuts will aim to counterbalance the earlier impacts of high interest rates on both consumer spending and housing investments.

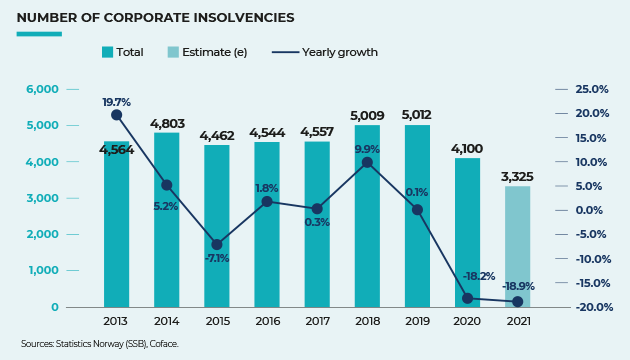

Norway's economic outlook is further bolstered by government spending, which is expected to remain an important driver of growth. Lower interest rates are expected to stimulate increased business investments, particularly within the hydrocarbon sector, thereby fostering more activity. The normalisation of insolvencies in the upcoming year, which implies a slight rise compared to 2023, suggests that the business landscape will stabilise.

However, a key concern lies in the exchange rate as the Norwegian krone continues to exhibit weakness against both the US dollar and the euro. This disparity may pose challenges for policymakers contemplating a rate cut, potentially delaying its implementation.

Balances helped by hydrocarbon production and exports

In 2024, Norway's current account balance continues to be characterized by its substantial goods surplus, primarily driven by hydrocarbon exports. The nation's hydrocarbon production is anticipated to rise, contributing to an expected improvement in the balance of goods. Conversely, the balance of services is likely to persist with a similar deficit or see a slight rise. One of the defining aspects of Norway's current account is the consistently high balance of income and current transfers stemming from its substantial foreign assets and investments. The country is home to the world's largest sovereign wealth fund.

Norway's public balance remains robust with a continued strong surplus, largely attributed to tax revenues derived from hydrocarbon production. Despite an increase in government spending, the country's public debt is anticipated to remain low, reflecting a stable fiscal approach. However, without oil and gas production and tax income, mainland Norway would continue to record a deficit.

Opposition gaining popularity

Norway’s next scheduled Parliamentary election is in September 2025. The political landscape is marked by interesting developments. The current coalition, comprising the Labour Party, Centre Party, and the Socialist Left Party, collectively holds 34% of voter support according to polls, far from a majority. Notably, the Conservative Party registered an impressive performance in the 2023 local elections, gaining more seats than the Labour Party for the first time since 1924, suggesting a shift in the political landscape. This success positions the Conservative Party as a strong contender at the next Parliamentary elections.

Last updated: March 2024

Payment

Bank transfers are by far the most widely used means of payment. All leading Norwegian banks use the BIC/SWIFT electronic network, which offers a cheap, flexible and quick international funds transfer service.

Centralising accounts, based on a centralised local cashing system and simplified management of fund transfers, also constitute a relatively common practice.

Electronic payments, involving the execution of payment orders via the website of the client’s bank, is widely used.

Bills of exchange and cheques are neither widely used nor recommended, as they must meet a number of formal requirements in order to be valid. In addition, creditors frequently refuse to accept cheques as a means of payment. As a rule, both instruments serve mainly to substantiate the existence of a debt. Conversely, promissory notes (gjeldsbrev) are much more common in commercial transactions, and offer superior guarantees when associated with an unequivocal acknowledgement of the sum due that will, in case of subsequent default, allow the beneficiary to obtain a writ of execution from a competent court.

Debt collection

Amicable phase

The collection process commences with the debtor being sent a demand for the payment of the principal amount, plus any contractually agreed interest penalties, within 14 days.

Where an agreement contains no specific penalty clause, interest starts to accrue 30 days after the creditor serves a demand for payment and, since 2004, is calculated on the basis of the base rate determined by the Central Bank of Norway (Norges Bank) in effect as of either January 1 or July 1 of the relevant year, raised by eight percentage points.

In the absence of payment or an agreement, creditors may go before the Conciliation Board (Forliksrådet), a quasi-administrative body. To benefit from this procedure, creditors must submit documents authenticating their claim, which should be denominated in Norwegian kroner.

The Conciliation Board then allows the debtor a short period to respond to the claim lodged before hearing the parties, either in person or through their official representatives (stevnevitne). At this stage of proceedings, lawyers are not systematically required. The agreement reached will be enforceable in the same manner as a judgement.

Legal proceedings

If a settlement is not forthcoming, the case is referred to the court of first instance for examination. However, for claims found to be valid, the Conciliation Board has the power to hand down a decision, which has the force of a court judgement.

A case which is referred to the higher court will commence with a summons to appear before the municipal or District Court. The summons will be served on the debtor with an order to give the court notice of intention to defend if he so wishes.

Where a defendant fails to respond to the summons in the prescribed time (about three weeks) or fails to appear at the hearing, the Board passes a ruling in default, which also has the force of a court judgement. The length of proceedings varies from one court to another.

More complex or disputed claims are heard by the court of first instance (tingrett). The plenary proceedings of this court are based on oral evidence and written submissions. The court examines the arguments and hears the parties’ witnesses before delivering a judgment.

Norway does not have a system of commercial courts, but the court of first instance is competent to hear disposals of capital assets, estate successions, as well as insolvency proceedings.

Enforcement of a court decision

A domestic judgment is enforceable for ten years if it has become final. If the debtor does not comply with the judgment, the creditor can request compulsory enforcement of the judgment from the enforcement authorities, which will then seize the debtor’s assets and funds.

Even though Norway is not part of the EU, particular and advantageous enforcement mechanisms will be applied for awards issued by EU countries, such as EU payment orders or the European Enforcement Order, under the “Brussels Regime”. For decisions rendered by non-EU members, they will be enforced on a reciprocity basis, provided that the issuing country is party to a bilateral or multilateral agreement with Norway.

Insolvency proceedings

Out-of court proceedings

Private non-judicially administered reorganizations are common in Norway; even though they are not regulated by law. Debtors and creditors are free to make any kind of arrangements, but in practice the Debt Reorganization and Bankruptcy Act is often applied. A third party (a lawyer or an accountant) can handle the process if the parties wish it so.

Restructuring the debt

This procedure can only be initiated by a wiling debtor. His financial situation is assessed with a court-appointed supervisory committee and a composition proposal is prepared. If the court agrees, a composition committee as well as a court appointed trustee will manage the debtors’ operations and formulate a composition agreement. A debt settlement proceeding may result in a completed debt settlement, composition or the commencement of a bankruptcy proceedings.

Bankruptcy proceedings

Proceedings can be opened by court decision either from the debtor or creditor. The latter must guarantee for expenses related to the proceedings. The court will appoint a trustee and assess the need for a creditor committee prior to issuing a bankruptcy order and given the creditors time to file their claim (three to six weeks). All of the debtor’s assets are confiscated, the debt is assessed and a list of approved claims is established.

If a settlement is not forthcoming, the case is referred to the court of first instance for examination. However, for claims found to be valid, the Conciliation Board has the power to hand down a decision, which has the force of a court judgement.

A case which is referred to the higher court will commence with a summons to appear before the municipal or District Court. The summons will be served on the debtor with an order to give the court notice of intention to defend if he so wishes.

Where a defendant fails to respond to the summons in the prescribed time (about three weeks) or fails to appear at the hearing, the Board passes a ruling in default, which also has the force of a court judgement. The length of proceedings varies from one court to another.

More complex or disputed claims are heard by the court of first instance (tingrett). The plenary proceedings of this court are based on oral evidence and written submissions. The court examines the arguments and hears the parties’ witnesses before delivering a judgment.

Norway does not have a system of commercial courts, but the court of first instance is competent to hear disposals of capital assets, estate successions, as well as insolvency proceedings.